The future of payment technology is increasingly digital, decentralized, and customer-driven. Businesses everywhere are adjusting their models, not just to keep up, but to stay relevant. This article explores how digital trends, especially cashless payment systems, are shaping business strategy, customer expectations, and operational decisions.

Key Takeaways

- Cashless transactions are transforming how businesses operate, streamline checkout, and engage customers.

- Mobile payments, QR codes, and contactless systems offer both opportunities and challenges.

- Choosing the right cashless payment solution requires balancing speed, cost, and security.

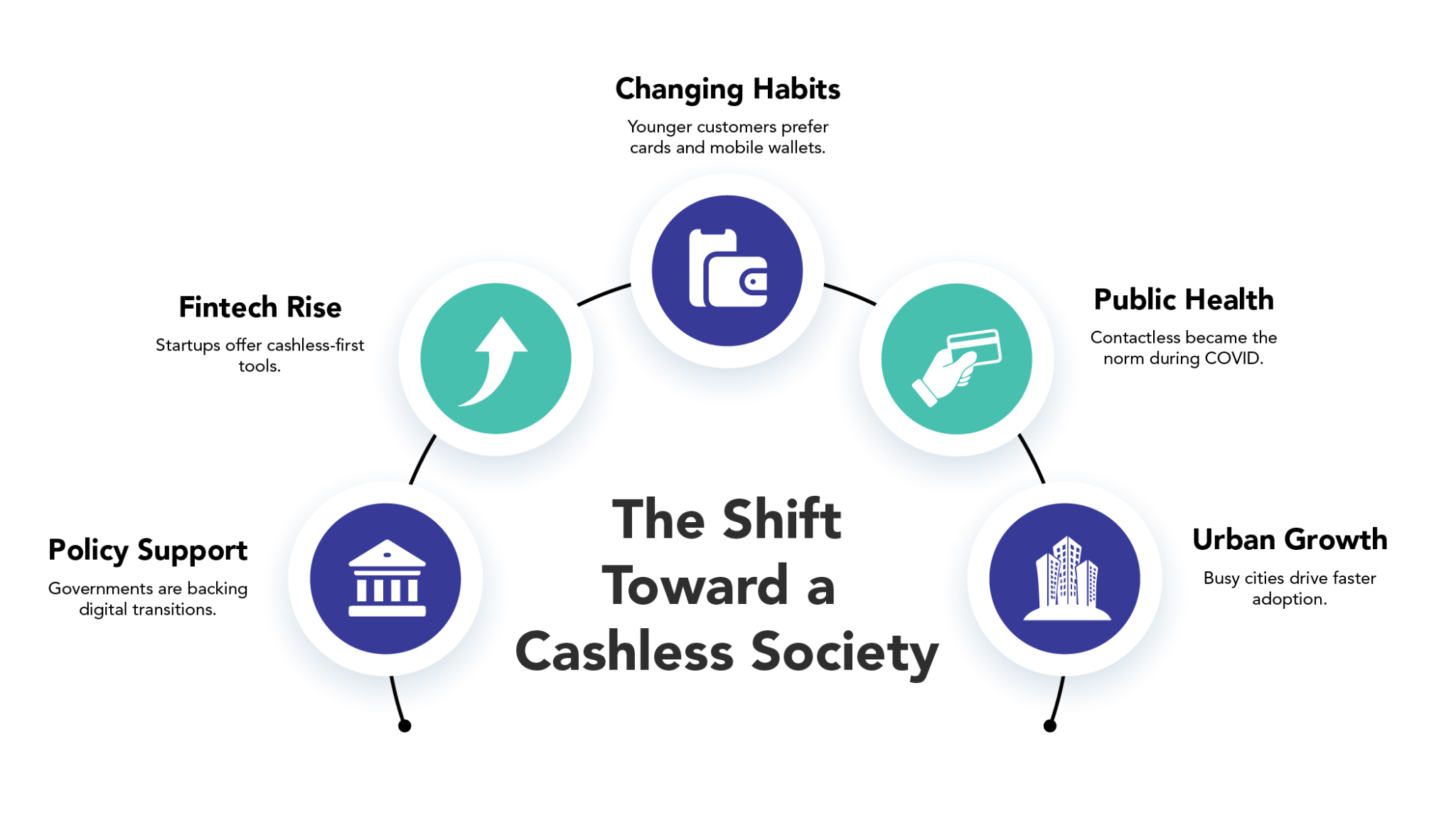

Shifting Toward a Cashless Society

Digital payments aren’t the future, they’re already here. Over the past decade, the momentum has clearly tilted toward cashless payment systems. You probably noticed it at your favourite café, where tapping your phone is now faster than fumbling with change.

As businesses lean into digital experiences, cashless transactions feel less like an option and more like an expectation. This isn’t just about convenience, it’s about aligning with a consumer base that’s grown used to instant everything.

- Changing habits: Younger generations rarely carry physical cash, relying on cards or mobile wallets for daily purchases.

- Urban push: Cities with dense populations are naturally quicker to adopt contactless tech due to high transaction volumes.

- Public health catalysts: The pandemic normalized minimal-contact payments, accelerating trends already in motion.

- Policy incentives: Some governments have provided infrastructure or tax perks for digital transitions.

- Banking evolution: Fintech startups and digital banks are offering integrated, cashless-first services.

Embracing Digital and Contactless Payments

For many businesses, contactless has become the default, especially in retail. Customers expect quick checkouts, and frankly, so do cashiers. It’s smoother for everyone, and it cuts down on queue times that used to drive people away.

Digital platforms are also expanding to serve more use cases: food delivery apps, ride-sharing, even vending machines. It’s becoming harder to find a sector that hasn’t at least tested some form of digital payment. The ease of these systems often overshadows their complexity. You tap, it pays. Behind the scenes, of course, it’s a web of APIs, tokenization systems, security layers, and payment gateways working in milliseconds to make it feel effortless.

Identifying Key Industries Adopting Cashless Solutions

Not every industry is moving at the same pace, although there’s momentum across the board. Some have fully embraced digital payments, while others are still experimenting with early adoption strategies. Each sector brings its own set of priorities, user expectations, and operational complexities to the shift toward cashless systems.

- Retail: The retail industry has adapted fastest, offering tap-to-pay and app-based ordering to match consumer speed expectations. Efficiency and volume make cashless adoption almost a necessity.

- Hospitality: The sector is catching up with mobile checkouts, digital tipping, and in-room ordering becoming more common. Personalization and seamless service are driving innovation here.

- Public Transit Systems: Many cities are replacing physical tickets with QR codes and contactless passes. The move improves throughput and aligns with mobile-first rider habits.

- Healthcare: Cashless is growing for co-pays and digital invoicing, although the change can feel unexpected. The complexity of billing and insurance integration adds friction but also opportunity.

- Government Services: Agencies are beginning to test digital payments for taxes, permits, and services. It’s still early, although the potential for efficiency and accessibility is considerable.

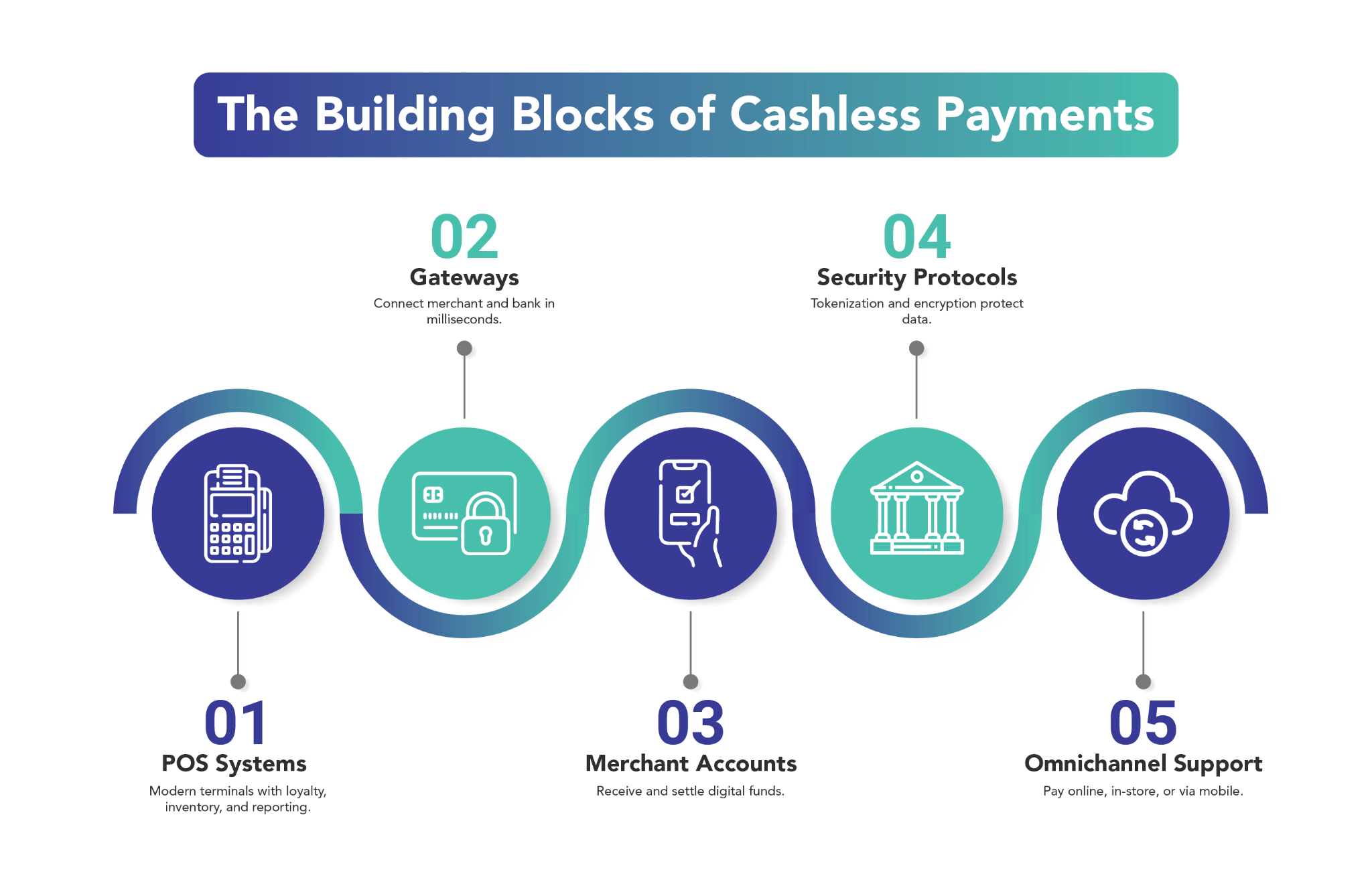

Understanding Cashless Payment Systems

To understand the impact of this shift, you need to understand the systems behind it. Cashless payment refers to any transaction that doesn’t involve physical money. Cards, apps, digital wallets, they’re all part of this ecosystem.

Each system has its own infrastructure, compliance layers, and customer experience. It’s not just about replacing cash, it’s about rethinking how people interact with money.

- POS systems: These are evolving to integrate loyalty, inventory, and reporting tools, far beyond swiping a card.

- Payment gateways: The digital toll booths connecting merchant and bank, often invisible to users but crucial for speed.

- Merchant accounts: Every business needs a reliable pipeline for accepting digital funds and settling them fast.

- Security protocols: Tokenization, encryption, and two-factor authentication now come standard.

- Omnichannel support: Whether your customer pays in-store, online, or through an app, it should feel seamless.

Explaining How Cashless Payment Works in Different Industries

In the retail industry, it’s a tap or scan, quick and expected. Hospitality has leaned toward convenience too, often using room charge apps or mobile checkout. Transportation, meanwhile, relies heavily on QR codes or smart cards, blending access and payment into a single action.

Healthcare may seem slower to adapt, although that’s starting to shift. More providers are offering mobile copay options, digital invoicing, and some integration with insurance platforms. The goal across all industries is largely the same: to make payment so seamless it fades into the background.

Comparing Payment Processing in Retail, Hospitality, and E-Commerce

Retail thrives on speed and volume, which means the payment systems need to handle quick transactions with minimal friction. Hospitality adds another layer, it’s not just about paying, it’s about customizing: tips, split bills, and delayed checkouts. E-commerce focuses more on trust and simplicity, where secure and reliable gateways help reduce cart abandonment.

Exploring the Role of Mobile and Digital Wallets

Apple Pay, Google Wallet, PayPal, they’ve moved from trendy to essential. Most consumers expect to use at least one of these for convenience, speed, or loyalty benefits. They also generate rich data, helping businesses understand habits and personalize experiences based on real-time insights.

Evaluating Mobile Payments, Contactless Cards, and QR Code Transactions

Each method suits a slightly different situation. Mobile payments are sleek and secure, although not every terminal supports them yet. Contactless cards are easy and fast, while QR codes offer flexibility, though in some regions, adoption remains inconsistent.

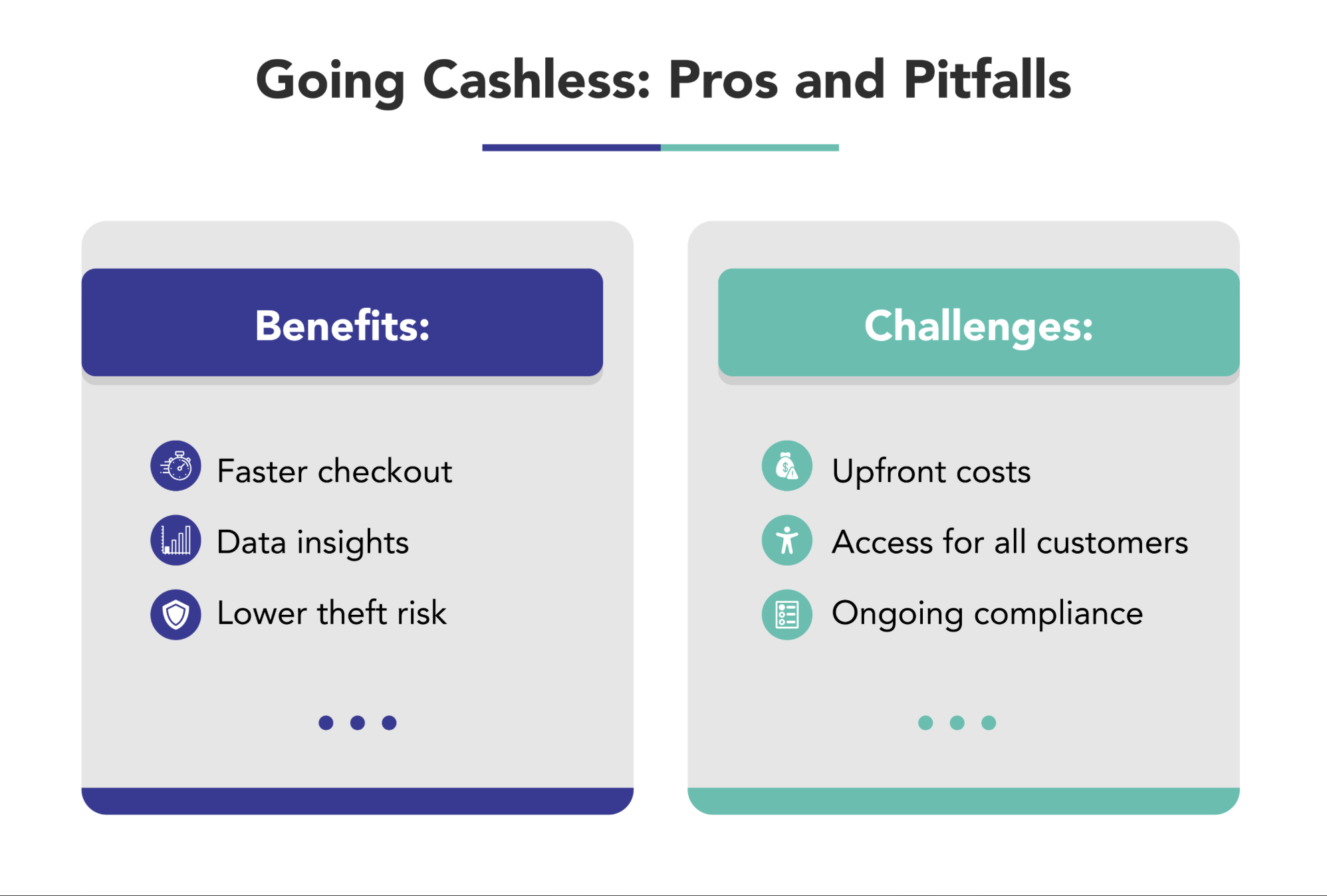

Benefits and Challenges for Businesses

Implementing cashless payment solutions offers businesses a compelling set of advantages, faster service, deeper insights, and operational simplicity. Yet it’s not without challenges. To truly benefit, companies must take a closer look at both the upsides and the trade-offs, planning ahead for what’s required to maintain balance and inclusivity.

- Efficiency Boost: Digital checkout is faster, reducing wait times and increasing throughput. It is better for user experience allowing customers to explore your website more efficiently.

- Customer Data: Every swipe or tap gives insight into buying behaviour. It also allows for more personalized marketing and product recommendations.

- Reduced Theft: Less cash on hand means lower risk for internal and external theft. Digital records leave a trail that helps monitor discrepancies.

- Upfront Costs: New hardware and software subscriptions aren’t free. These costs can scale depending on the number of locations or devices.

- Access Concerns: Not all customers are ready, or able, to go cashless. Consider the implications for customer satisfaction and brand perception.

- PCI-DSS Standards: Any business processing cards must meet these baseline security protocols. Without them, businesses risk penalties, breaches, and reputational damage.

- Data Encryption: Essential for protecting customer information across every touchpoint. It keeps sensitive data unreadable to anyone without authorization.

- Secure Endpoints: It’s not just your servers, every terminal, phone, and tablet matters. Weak links in any device can compromise the entire system.

- Audit Trails: Digital records create transparency and help during disputes or investigations. They also assist with internal reviews and long-term accountability.

- Customer Trust: Once lost, it’s hard to get back. Transparency helps. So does consistent, visible attention to security across all payment interactions.

- Ongoing Compliance Practices: Regular updates, third-party audits, and staff training help businesses stay aligned with shifting standards. Technology evolves fast, and so do the risks that come with it. Staying current isn’t optional, it’s critical for reducing exposure.

- AI-Driven Fraud Protection: Pattern recognition, real-time alerts, and anomaly detection are now common features in modern payment systems. These capabilities help spot suspicious behaviour quickly and reduce false positives. AI is becoming essential for protecting both customer trust and business integrity.

Emerging Tech Shaping the Future of Payment Technology

Legacy systems are quickly falling behind as payment technologies evolve beyond incremental improvements. Tools like AI and machine learning are streamlining payment experiences, predicting behaviour, and enhancing fraud detection. Instant settlement, digital wallets, and blockchain frameworks are reshaping what fast, secure, and transparent transactions look like.

Integrating AI and Machine Learning in Payment Technology

AI tools are being baked into POS systems, fraud engines, and analytics dashboards. They’re reducing manual input and enhancing precision. And they’re scalable, which matters if you’re growing. These tools also adapt over time, refining accuracy and response as they gather more data. That makes them increasingly indispensable, especially in competitive markets.

Enabling Real-Time Payment Processing for Operational Efficiency

Delays frustrate customers. Real-time payments make refunds faster, reduce chargebacks, and improve cash flow visibility. You can act on data as it happens. This responsiveness strengthens customer trust and gives teams a clearer operational picture. Ultimately, it minimizes downtime and missed opportunities.

Improving Cash Flow Through Instant Transactions

It seems small, getting paid a day earlier. Yet over weeks and months, it adds up. You can invest, restock, or hire with confidence, not estimates. A smoother cash cycle also helps with vendor relationships. And it gives finance teams more breathing room for strategic planning.

Forecasting the Future of Blockchain and Cryptocurrency in Payments

Adoption is still fragmented. Regulation is catching up. Still, the principles of transparency, speed, and decentralization are influencing even traditional finance tools. Many businesses are watching closely, weighing feasibility and potential use cases. Even cautious adopters are starting to explore pilot programs.

Redefining Transactions Through Decentralized Payment Systems

You might not replace your Visa machine with a wallet address today. Still, the idea of direct, peer-to-peer digital payments is forcing bigger players to evolve. It challenges legacy infrastructure and opens space for more democratized financial tools. Even if it scales fast or not, it’s already reshaping how we think about transaction control. That conversation isn’t going away anytime soon.

Final Thoughts: Preparing Your Business for Tomorrow’s Payments

You don’t need to overhaul your entire operation overnight, but you do need a plan. Start by identifying one area in your business where digital payments can reduce bottlenecks or enhance customer experience. Then test a solution, analyze real feedback, and iterate based on what works. The future of payment technology isn’t just about speed, it’s about building smarter, more resilient systems that align with customer expectations and operational goals. With Access2Pay, you gain the infrastructure to turn every transaction into actionable insight, streamlining operations, uncovering patterns, and staying responsive to emerging trends. Choosing the right cashless solution means rethinking how people interact with your brand and why they keep coming back. That “why” is shifting rapidly, shaped by convenience, trust, and personalization. Start early, stay flexible, and let Access2Pay help you scale efficiently and intentionally.