Most payment systems promise the same things: simplicity, speed, and security. And that’s fine, those are table stakes. What sets the best apart is how they handle the messy stuff: changing workflows, custom payment needs, and real-world retail environments where things rarely go according to plan.

In this comparison, we’ll break down the core differences between Access2Pay vs EPoS Now. You’ll get a realistic view of features, usability, customization, and more. We’ve even added a few small opinions, reactions, really, that you might relate to because no one buys software in a vacuum.

Key Takeaways

- Access2Pay is more customizable and scalable for complex, multi-location businesses.

- EPoS Now leans heavily on simplicity and works well for small to mid-sized retail and hospitality setups.

- Your final choice may come down to what kinds of custom payment features matter to your team.

Access2Pay and EPoS Product Overviews

Access2Pay is a Canadian-built payment solution built with adaptability at its core. It’s particularly strong in complex environments, think franchises, retailers with multiple locations, or government operations, where off-the-shelf POS systems fall short. The platform supports a broad mix of payment methods, from standard card processing to custom QR and mobile options, and it allows for custom payment gateway setups that align tightly with specific operational needs.

What makes Access2Pay stand out isn’t just the breadth of features, though. It’s the way you can bend the system to fit your structure. Want to plug into industry-specific software, connect with regional accounting systems, or align checkout processes with internal workflows? Access2Pay handles that with ease.

On the flip side, EPoS Now was designed with clarity and ease-of-use front and center. Originally launched in the UK, it has gained traction globally, including across Canada, by focusing on streamlined, pre-built experiences that appeal to small-to-mid-sized retailers and hospitality businesses.

The system includes everything from inventory tracking to simple CRM to employee scheduling, all with a visual, user-friendly interface. You don’t need much onboarding to get started. The workflows are clean, the interface is intuitive, and most business owners find that they can get up and running in under a day.

Access2Pay, by comparison, asks you to be a bit more deliberate. There’s more to configure, but you’re rewarded with a tailored experience that feels like it was built specifically for your operation.

Customers using Access2Pay get payment interfaces that feel seamless and adaptive, an important edge when trying to match preferences across different customer groups and types of payment solutions.

With EPoS Now, the goal is simplicity. Predefined workflows remove decision fatigue. Your team needs little training. Your customers encounter a consistent, straightforward checkout process. In many ways, it’s the POS version of choosing a template that already knows what you need, and for a large number of businesses, that’s a welcome relief.

Key Features of Access2Pay vs. EPoS Now

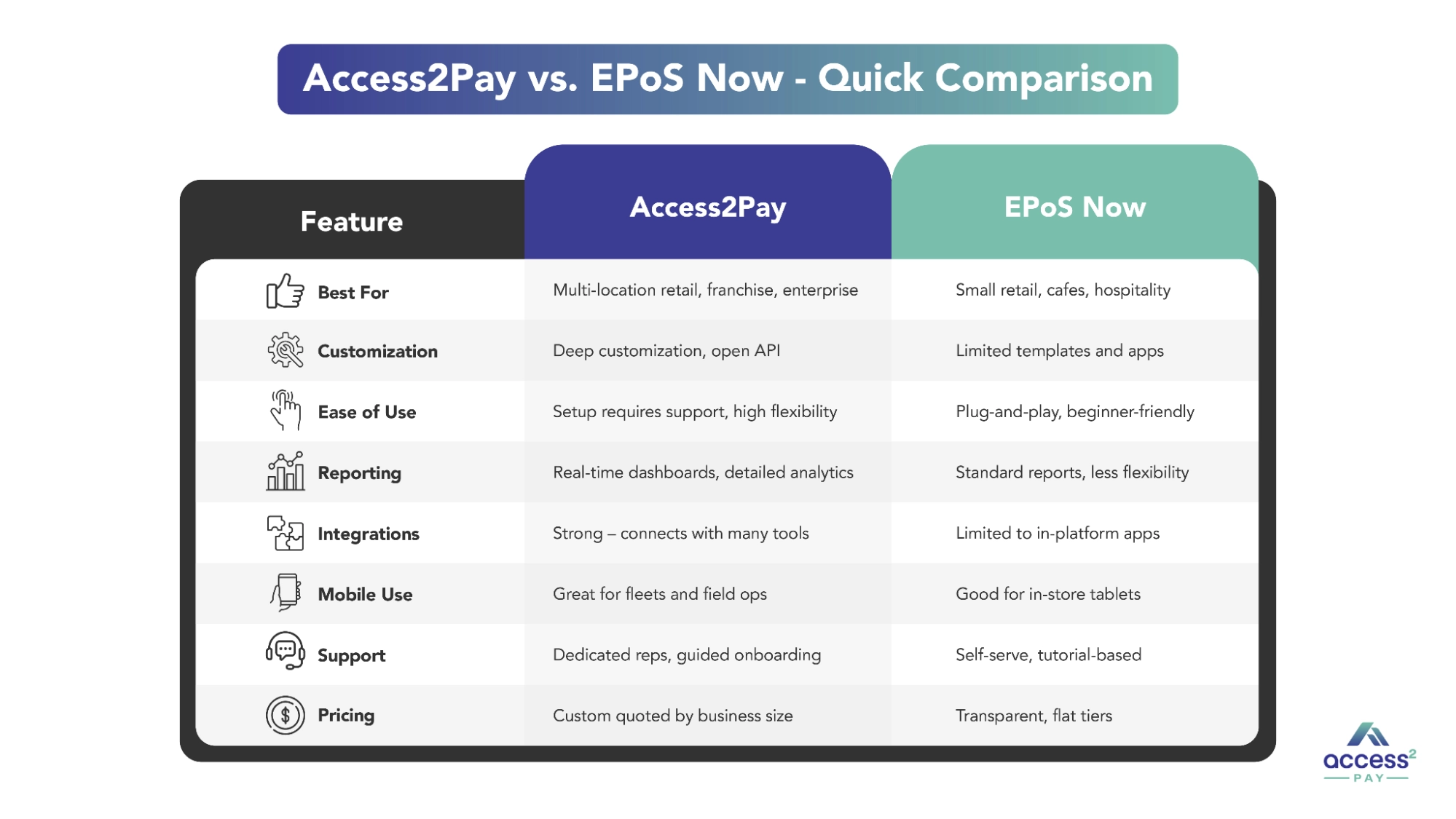

When it comes to evaluating a payment platform, it’s easy to get lost in a sea of features. Lists. Bullet points. Sales claims. And while those can be helpful, they rarely tell the full story. What you really need is a practical view, something that puts each system’s strengths side by side, in a way that reflects how real businesses operate.

That’s what this section is about. We’re looking at how Access2Pay vs EPoS Now compare across core functions, things like inventory, transactions, customer tools, reporting, and integrations. Not just what they offer, but how it all works when it’s in your hands day after day.

| Feature | Access2Pay | EPoS Now |

| Inventory Management | Advanced, supports multi-warehouse | Basic, best for single-location |

| Sales & Transactions | Omnichannel, high volume support | Retail-focused, intuitive interface |

| Customer Management | Integrated CRM, loyalty tools | Built-in customer notes, simple tracking |

| Reporting & Analytics | Custom dashboards, real-time data | Standard reports, pre-set templates |

| Integrations | High flexibility, open API | Limited to the app store ecosystem |

Inventory Management

If you’re managing multiple warehouses or suppliers, Access2Pay gives you better visibility. You can segment stock, monitor transfers, and forecast based on custom triggers. EPoS Now covers the basics, though it can get clunky with large catalogs.

Sales and Transactions

Access2Pay handles high-volume sales smoothly, especially if you operate across regions. The omnichannel support is reliable. EPoS Now is cleaner on the front end. It’s quicker for a cashier or barista, for example, to learn and use.

Customer Management

Access2Pay includes robust CRM tools, customer segmentation, purchase history, and automated messaging. EPoS Now? It logs basic customer info and notes, which might be all you need if loyalty programs aren’t central to your growth.

Reporting and Analytics

One of Access2Pay’s strong suits. Custom dashboards let you track exactly what matters to you. Daily gross sales, average checkout time, failed payments, name it. EPoS Now gives you a set of default reports. Handy, but not deep.

Integrations

Access2Pay wins here, no contest. If your tech stack isn’t cookie-cutter, you’ll appreciate the open API. EPoS Now offers some integrations via its app marketplace. But custom connections? Not really its thing.

Ease of Use of Access2Pay vs. EPoS Now

How a system feels to use, day in, day out, can have a bigger impact than you might expect. This section compares the hands-on experience of Access2Pay vs EPoS Now, focusing on setup, support, pricing clarity, and what users actually say after going live.

| Category | Access2Pay | EPoS Now |

| User Interface & Setup | Flexible, may need support to configure | Intuitive, plug-and-play setup |

| Training & Support Resources | Guided onboarding, tailored help | Self-service, video tutorials |

| Pricing | Tiered plans based on business size | Transparent, flat pricing tiers |

| Customer Support | Dedicated account reps, live chat | Email and call-back support |

| Customer Reviews | Highly rated for enterprise tools | Favoured by small business owners |

User Interface and Setup

Access2Pay lets you design your own flow, which is great unless you hate setup. EPoS Now skips the complexity. You log in, follow a few steps, and go.

Training and Support Resources

Access2Pay offers tailored onboarding, often with dedicated reps. Helpful, especially if you’re replacing legacy systems. EPoS Now’s help library is wide-ranging, and there’s a certain comfort in watching a quick tutorial at midnight.

Pricing

Access2Pay offers quote-based pricing, which can vary depending on your scale and needs. EPoS Now has posted pricing tiers. It’s easier to understand at a glance, though less flexible if your situation is unique.

Customer Support

Access2Pay has real people on standby, including account reps for large clients. EPoS Now promises support too, though you might wait a bit longer to hear back.

Customer Reviews

People like Access2Pay for its adaptability. The trade-off is a steeper learning curve. EPoS Now wins loyalty for its ease of use, especially from first-time business owners.

Customization and Scalability of Access2Pay vs. EPoS Now

Some businesses need a system that adjusts as they grow, not one they’ll outgrow. This section looks at how well Access2Pay vs EPoS Now adapts to evolving business needs, both in terms of customization options and long-term scalability.

| Category | Access2Pay | EPoS Now |

| Customization Options | Deep customization, industry-specific tools | Limited, preset functions |

| Scalability | Enterprise-ready, supports growth | Best for small-to-mid businesses |

Customization Options

This is where Access2Pay shines. You can modify workflows, build a custom payment method, even design your checkout UX. EPoS Now works fine if you’re okay with templates.

Scalability

Access2Pay grows with you. New locations, more users, added services, it adapts. EPoS Now is solid, though once you hit a certain scale, it starts to feel tight.

Pros and Cons of Access2Pay vs. EPoS Now

Every system has trade-offs. This section gives you a straight look at what each platform does well, and where it might fall short, so you can decide what matters most to your business.

| Pros | Cons | |

| Access2Pay | High configurability, enterprise support, detailed analytics | Takes time to set up, and pricing varies |

| EPoS Now | Easy to deploy, intuitive UI, affordable | Limited integrations, basic reporting |

Access2Pay Pros

You get full control. That means tailored reporting, branded experiences, advanced point of sale features, and true operational insight. It feels like enterprise tech.

EPoS Now Pros

You’re up and running fast. If you want to take payments, manage stock, and serve customers quickly, this does the trick. And it does so cleanly.

Access2Pay Cons

It might take longer to set up. And the pricing isn’t instantly clear, it’s often custom quoted. That can make planning difficult at first.

EPoS Now Cons

You might hit a wall. As your needs grow, the platform won’t always keep up. That could mean switching systems later.

Benefits of Using Payment Gateways

Payment gateways, like these two, simplify everything. They allow for smooth custom payment setups, automate transactions, and give you access to multiple payment methods, from cards and mobile to emerging options like QR-based checkout. They also help you track income, reduce fraud, and adapt to what customers prefer.

Whether you pick a highly customizable custom payment gateway like Access2Pay or something pre-configured like EPoS Now, you’re essentially choosing how much control you want.

FAQs

What Industries Does Access2Pay vs EPoS Now Serve Best?

Access2Pay tends to serve more complex operations, particularly those in retail, franchise chains, and public sector environments. These clients often require a mix of compliance, multi-location support, and deeper integration options. EPoS Now, on the other hand, is more commonly seen in hospitality settings, independent cafes, boutique stores, and service-based retail operations that prefer pre-built functionality and straightforward workflows.

Can I Use Custom Payment Methods with Both Platforms?

Custom payment methods are fully supported within Access2Pay. The platform was designed with flexibility in mind, so businesses that need non-standard payment flows, hybrid checkout models, or specialized third-party payment apps can often build them into their workflow. EPoS Now does include basic alternative payment support, but it’s largely limited to what is already offered in its app marketplace. If you need something tailored, you may hit a ceiling.

Do Both Platforms Support Mobile Transactions?

Both Access2Pay vs EPoS Now work well on mobile. Whether you’re using tablets, smartphones, or handheld terminals, both systems are designed to support mobile transactions in the field or in-store. That said, Access2Pay is typically found in more complex mobile deployment scenarios, such as mobile fleet setups or on-location service providers who also require integrated reporting back at the head office.

Is Training Provided?

When it comes to training, both platforms provide support, though the experience differs. Access2Pay typically assigns onboarding specialists for new clients, especially larger or more complex setups. These reps help configure the system, provide guided training, and assist with change management. EPoS Now tends to rely more on self-serve options like video tutorials, help docs, and knowledge base articles. It’s effective, especially for smaller teams, but may require a bit more trial and error during setup.

Final Thoughts

Choosing between Access2Pay vs EPoS Now really comes down to what you need today, and how much change you expect tomorrow. If your business demands flexibility, deep integrations, and support for custom workflows, Access2Pay is built to deliver. If you’re looking for a fast setup, straightforward features, and a system that just works out of the box, EPoS Now could be a great fit.

Think about where your business will be in the next six to twelve months. Are you scaling? Adding locations or services? Needing more operational insight? If so, the flexibility of Access2Pay will serve you well. If stability and simplicity are your priority, EPoS Now can help you stay focused on the day-to-day.

Either way, you’re looking at two capable systems. The key question is: how much control do you want over the way you take and manage payments? Because your payment gateway shouldn’t just support your business, it should work the way you work.