A cloud-based payment gateway is a digital bridge that lets businesses accept, authorize, and settle online payments, without being tied to hardware or localized servers. It’s flexible, remote-friendly, and built to grow with your business.

In this article, we’ll walk through how it works, why it matters, and how it’s shifting the future of digital transactions. We’ll cover technical basics, break down the benefits and security measures, and explore what’s on the horizon. You’ll also see how artificial intelligence, compliance standards, and real-world trade-offs all factor into choosing the right platform for your team.

Key Takeaways

What is Cloud Payment and Why Does it Matter for Businesses

Let’s clear this up right away. When people ask, “What is cloud payment?” they’re usually referring to a system where transaction processing is handled remotely, on cloud servers, rather than on local devices or legacy hardware. That’s really it.

Now, the reason this matters is simple: modern business isn’t sitting still. You’re managing multiple sales channels, teams in different time zones, maybe even customers halfway across the world. A traditional, location-locked setup can’t really keep up.

With a cloud based payment gateway, your transactions don’t need to wait. You get 24/7 availability, remote access, real-time reporting, without the headache of maintaining physical servers. That’s a serious operational advantage, especially if you’re scaling fast, adjusting to seasonal spikes, or just tired of system downtime during updates.

And maybe you’ve already felt that friction, delayed authorizations, inconsistent syncing, sudden blackouts. Cloud based payment processing helps remove all of that from your day-to-day.

The Role of Cloud Technology in Modern Transactions

Cloud computing isn’t new, but its role in payment processing has expanded dramatically. It’s not just about speed, it’s about resilience.

Let’s say you run an eCommerce business. A spike in traffic hits during a promo campaign. If your infrastructure can’t handle that load, transactions fail. Customers walk. Cloud-based payment platforms handle those spikes dynamically, scaling resources up or down without a second thought.

It’s also about reach. With cloud based payment systems, updates are pushed automatically. No waiting on IT. No outdated terminals. No surprise compatibility issues when a browser updates.

More subtly, though, it’s also about how this tech disappears into the background. That’s the goal, right? The best systems are the ones you don’t think about because they just work.

How Payment Gateway Works: A Step-by-Step Breakdown

Understanding how payment gateways function isn’t just a tech deep dive. It’s operationally relevant. Here’s how it breaks down, simplified, but practical.

1. Starting the Transaction

It always begins with the customer. They either type in their payment info online, maybe on your checkout page, or tap their card at an in-store terminal. That’s the starting signal. The system kicks into gear behind the scenes.

2. Securing the Payment Info

As soon as the details are entered, your payment gateway encrypts everything, credit card numbers, expiry dates, the works, using secure protocols like SSL or TLS. You don’t really see this happening, but it’s crucial. It protects the data as it travels.

3. Sending the Data

That encrypted information gets passed to your acquiring bank. Think of it as the middleman between you and the customer’s bank. From there, the acquiring bank forwards it along to the issuing bank, the one that holds your customer’s funds, or sometimes, to a third-party processor.

4. Verification Behind the Scenes

Now the issuing bank checks things over. Are the funds available? Does the card match the name and address? Has there been any suspicious activity lately? All that happens in a blink, most of the time. It’s where risk assessments come into play.

5. Getting a Response

Based on those checks, the issuing bank sends back a decision. Approved, declined, flagged, whatever it is, that message travels back through the gateway, encrypted the whole way. You don’t get to peek into this decision, only the result.

6. Passing the Message Along

Once the gateway has the bank’s decision, it tells your system fast. If it’s a go, your platform confirms the purchase. If it’s declined, your customer gets that awkward message we’ve all seen at some point.

7. Completing the Settlement

When everything’s approved, that’s when funds actually start to move. The money flows from your customer’s bank to your merchant account, usually over a few business days. Some systems can do this quicker, depending on the agreements in place. Either way, the technical term here is settlement.

So, if you’ve ever wondered how a payment gateway works, this is the flow. It sounds simple enough, and honestly, it should feel that way from your end. Complexity should stay behind the scenes.

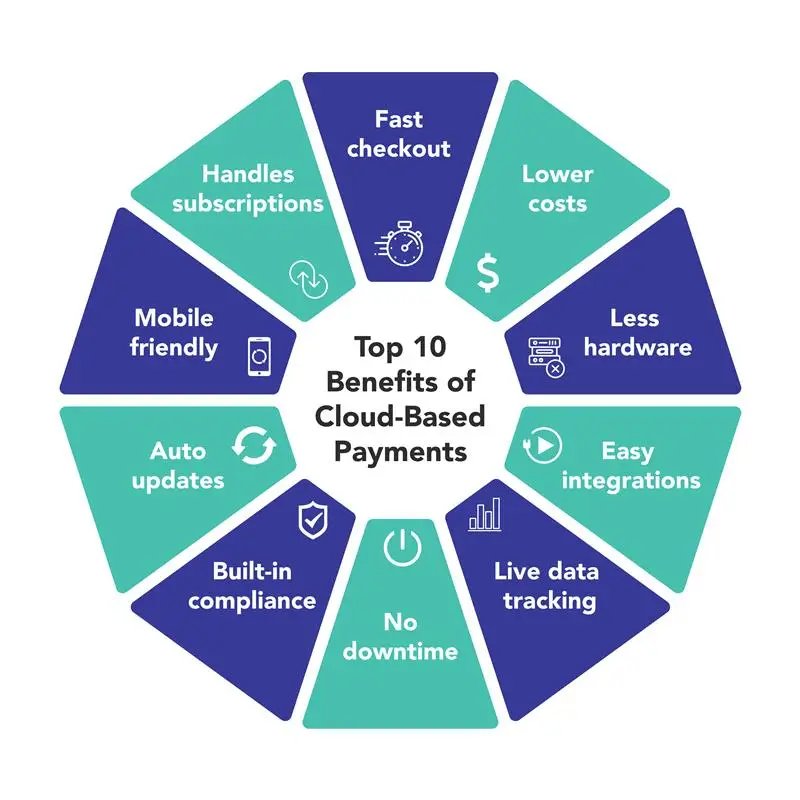

10 Key Benefits of Cloud-Based Payment Processing

Before we get into technical specifics, here’s the big picture: cloud based payment gateways let you move faster, manage less, and scale more easily. They’re built to reduce friction, on both the customer and operational side. Less time fixing stuff, more time focusing on what actually drives revenue.

Here’s what that looks like in practice:

- Faster Transactions: Cloud systems process payments quickly and reliably without relying on local hardware.

- Lower Operational Costs: No need for servers, licenses, or constant IT support, everything runs from the cloud.

- Reduced Infrastructure Burden: Your provider handles the backend, so there’s less maintenance and fewer outages.

- Easy Tool Integration: Works seamlessly with platforms like Shopify, QuickBooks, and CRMs, often with plug-and-play setups.

- Real-Time Insights: Get instant access to payment data, trends, and performance through built-in dashboards.

- Built-In Redundancy: Systems reroute traffic automatically to prevent downtime during outages.

- Simplified Compliance: PCI DSS and other standards are built into the platform’s infrastructure.

- Automatic Updates: Security patches and new features are applied in the background with no disruption.

- Mobile-Friendly and Omnichannel: Supports smooth transitions across devices for a better customer experience.

- Subscription-Ready: Built-in tools support recurring billing, trials, and renewals without custom development.

Improving Security and Scalability of Cloud-Based Payment

Security and uptime are non-negotiable. A single breach or slowdown can lead to lost sales and customer trust. Cloud-based payment gateways reduce that risk with real-time fraud detection and systems that scale automatically as your traffic grows. Here’s what that protection looks like in action:

- Real-Time Fraud Detection: Cloud gateways monitor global traffic to spot and respond to suspicious activity instantly.

- Behavioral Biometrics: Systems analyze how users interact with devices to detect unusual behavior patterns.

- Device Fingerprinting: Each device is uniquely identified, reducing the chance of spoofing or repeated attacks.

- Velocity Checks: Rapid, repeated transactions are flagged as potential fraud attempts before they go through.

- Tokenization: Sensitive data is replaced with digital tokens, protecting it even if intercepted.

- End-to-End Encryption: Data is encrypted from the moment it’s entered, all the way through transmission and storage.

- Scalable Infrastructure: Cloud systems automatically adjust to traffic spikes, ensuring consistent performance.

- Standardized Security Features: These protections are becoming the baseline expectation for modern payment platforms.

The Role of AI and Machine Learning in Cloud Payment Security

AI and machine learning aren’t just buzzwords in the cloud payment world—they’re quietly powering some of the most effective security and optimization features available today. While much of their work happens in the background, the impact is significant: fewer fraudulent transactions, faster responses to threats, and smarter systems that get better over time.

In the context of cloud-based payment gateways, AI doesn’t just protect your business – it helps it adapt, scale, and deliver smoother experiences for your customers. Here’s how it works in practice:

- Real-Time Fraud Detection: AI systems analyze huge volumes of global payment data to catch suspicious activity as it happens.

This early detection allows platforms to stop fraud mid-transaction, instead of reacting after losses occur. - Smart Authentication: Identity checks adjust dynamically based on the assessed risk of each transaction—low-risk users experience fewer steps, while high-risk ones are flagged.

This balances security and user experience, helping reduce cart abandonment without compromising protection. - Dynamic Transaction Scoring: Every transaction gets a risk score based on behavior patterns, device info, and other contextual signals.

High-risk scores trigger additional checks, helping filter out fraud without blocking legitimate users. - Behavioral Pattern Mapping: AI models learn your customers’ normal shopping habits, then watch for deviations that suggest fraud.

This personalization helps the system recognize unusual behavior faster and more accurately than static rules. - Automated Alerts and Blocking: When fraud is detected, the system sends real-time alerts and can instantly block the transaction.

This prevents damage before it reaches your systems or your customers. - Continuous Learning Models: Machine learning algorithms evolve with every new data point, improving fraud detection and reducing false positives.

Over time, the system becomes more precise, less reactive, and better aligned with your business needs.

Compliance and Regulatory Considerations for Cloud Payment Gateways

Compliance may not be the most exciting part of cloud-based payment processing, but it’s one of the most important, especially if you’re handling sensitive data in regulated industries like finance, healthcare, or government.

The right gateway helps you stay aligned with security standards and privacy laws, though some responsibility still falls on you. Knowing which regulations apply, and how your provider supports them, is key.

PCI DSS and Data Security

If you’re processing credit card payments, PCI DSS compliance isn’t optional. Look for gateways that meet Level 1 certification, the highest standard.

This usually includes:

- Full encryption during every stage of the transaction.

- Secure infrastructure, with regular third-party audits.

- Strict user access controls.

Don’t just take “we’re compliant” at face value, ask for details. Documentation matters.

Privacy Laws: GDPR, PIPEDA, and CCPA

Your obligations change depending on where your customers live:

- GDPR applies to EU users and focuses on consent, data rights, and transparency.

- PIPEDA is Canada’s privacy law and governs how businesses handle personal information.

- CCPA gives California residents rights over their data, including access and deletion.

If you’re selling globally, make sure your provider supports data residency options, export controls, and user consent flows.

Other Frameworks to Know

Some industries require even more:

- HIPAA, if you’re handling health-related payments.

- SOC 2, for demonstrating internal data controls.

- ISO 27001, a global benchmark for information security.

You might not need all of these, though if your clients do, your provider should at least have them on the radar.

FAQ

What is cloud payment in plain terms?

It’s when payment processing happens on the internet, not on your local device. You use a browser or app to handle transactions, but the “heavy lifting” happens on a remote server, secure, scalable, and always on.

How does a cloud-based payment gateway differ from traditional systems?

Traditional systems are usually tied to physical infrastructure, servers, terminals, and onsite maintenance. Cloud gateways operate remotely and can scale, patch, and evolve faster.

Is cloud-based payment secure?

It can be very secure, sometimes more so than legacy options. That said, it depends on the provider. Look for strong encryption, compliance credentials, and active fraud prevention protocols.

Can a small business use cloud-based payment processing?

Absolutely. In fact, it’s often more cost-effective than traditional terminals or custom infrastructure.

Does AI make payment gateways fully automated?

Not fully. AI helps spot fraud, analyze behavior, and optimize workflows, though human oversight is still important, especially when dealing with edge cases or disputed transactions.

Final Thoughts: The Future of Cloud-Based Payment Technology

If there’s one theme running through all of this, it’s that cloud-based payment gateways don’t just move transactions. They move with you.

They grow as you grow. They scale as your customer base shifts. And while they aren’t magic wands, they do remove many of the friction points that used to slow businesses down, especially those with hybrid or online-first models.

The future? It’s probably going to be more automated. More integrated. Possibly even invisible, in the best sense. You might not need to “process” payments at all in the traditional way. Systems will know. They’ll route. They’ll reconcile.

Of course, it won’t all happen overnight. And that’s fine. Start where it makes sense, maybe it’s switching your current gateway to a more flexible one. Maybe it’s just better analytics. You don’t need to overhaul everything to start seeing value.

That’s the beauty of cloud-based payment. You opt in gradually, but benefit immediately.